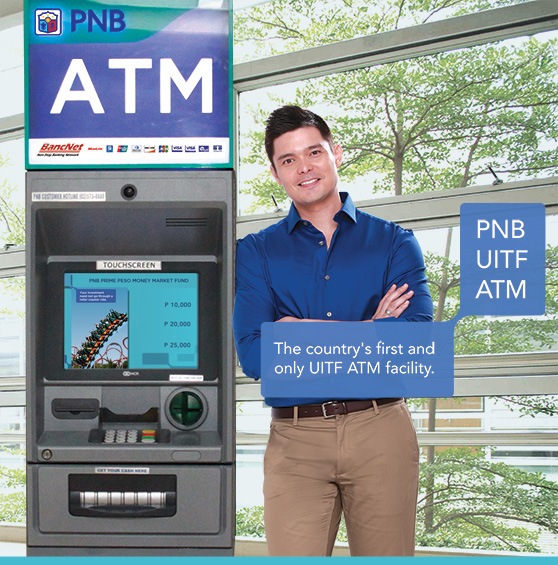

Simple investments. Greater accessibility.

Investing for your future is easier than ever with the PNB UITF ATM. Now, you can easily participate in the PNB Prime Peso and Dream Builder Money Market Funds anytime.

Open a Unit Investment Trust Fund (UITF) account now

to access the UITF ATM Facility*.

* Redemptions are not available in the UITF ATM Facility.

All funds/accounts managed by PNB Trust Banking Group (Trustee) are Trust and/or Investment Management funds which DO NOT carry any guaranty of income or principal, and are NOT covered by the Philippine Deposit Insurance Corporation (PDIC). Due to the nature of the investments, potential yield cannot be guaranteed. It is also possible for the investments and their income to fluctuate as a result of prevailing market conditions. Past performance is likewise not a guarantee of future results. Any loss or income is for the account of the Trustor/s. The Trustee is not liable for losses except upon fraud, gross negligence or bad faith.

- What are UITFs?

UITFs are investment products where the money of various investors with similar objectives are pooled together and invested by a professional and experienced fund manager. This pooled fund is then invested in various financial instruments that are otherwise accessible only to big, individual investors. These instruments include government securities, bonds, commercial papers, and deposit products. Investments in UITFs are easy to redeem or ‘realize’ at any time, giving investors a flexibility not available with time deposits.

- What is the UITF ATM?

The PNB UITF ATM facility allows existing clients with PNB UITF accounts to easily invest their hard-earned money round-the-clock at PNB ATMs strategically located all over the country. With this new ATM service, clients can simply select the UITF type they want to participate in, choose a desired amount, and instantly place their investments in their UITF account.

- Do all PNB ATMs have the UITF ATM facility?

Yes, the PNB UITF ATM facility is available in all PNB ATMs nationwide.

- What UITFs are currently available via the PNB UITF ATM Facility?

The PNB UITF ATM serves as an additional channel for the two (2) PNB UITFs:

Currently available through this UITF ATM facility are two of PNB’s 12 UITFs, the PNB Prime Peso Money Market Fund and the Dream Builder Money Market Fund.PNB Prime Peso Money Market fund

- Ideal for clients looking for safe and liquid investments

- Invested purely in deposit instruments

- Provides better returns than time deposits

- Has a minimum holding period of only five (5) banking days

- Suitable for clients with short-term investment horizons

PNB Dream Builder Money Market fund

- Ideal for clients interested in building a stronger foundation for their children’s future

- Can be used for their children’s college funds, endowment gifts, or even start-up capital for a future small business

- Minimum initial participation is only Php 2,000

- What do I need to start using the UITF ATM?

The UITF ATM is available to customers who already have an existing PNB UITF account and with a corresponding PNB ATM card. No other application is needed.

- How do I use the UITF ATM?

- At any PNB ATM, insert your ATM card and enter your Personal Identification Number (PIN).

- Upon PIN entry, a screen will show the products you can avail of. This will include the two UITFs available for participation: the Prime Peso and Dream Builder Money Market Funds.

Note: This screen will only appear if you are using a PNB ATM card. - After selecting a UITF option, you will be directed to the Account Selection screen.

- Once you select an account type, you will be asked to select a placement amount.

- After you choose the amount, you will be asked to confirm your participation.

Note: If you select “NO”, you will be directed to the ATM’s main menu - If you choose “Yes”, the card will go through the standard validation process (e.g. PIN validation, etc).

- Once validated, a confirmation screen will appear informing you that participation is successful. Your COP will be then automatically be delivered to client’s maintaining branch.

- The ATM shall issue a transaction receipt as proof of the client’s participation in the PNB UITF.

- If ATM is currently unable to issue a transaction receipt, participation will automatically be cancelled and client will be prompted with the following message: “Your transaction cannot be processed. Please call Customer Care at +63 (02) 573-8888

- If client has no existing UITF account with PNB, client will be prompted to enroll first in UITF Online or open a UITF account with his/her maintaining branch.

- Can I redeem funds through the PNB UITF ATM facility?

At present, redemptions are not allowed via the PNB UITF ATM Facility. All requests for redemption must be coursed through the client’s servicing branch. Existing policies and procedures for manual redemption shall apply.